PHILIPSBURG:--- The Parliament of Sint Maarten is embroiled in intense debates over critical economic and governance issues, with Members of Parliament (MPs) demanding clarity and accountability from the Minister of Tourism, Economic Affairs, Transport, and Telecommunications (TEATT), Grisha Heyliger-Marten. The discussions have centered on the impact of U.S. tariffs, GEBE's accountability, and the broader performance of the current coalition government. Former Minister of Public Health, Social Development, and Labor (VSA), MP Omar Ottley, has been particularly vocal, calling out what he describes as the "worst government since St. Maarten obtained its country status."

PHILIPSBURG:--- The Parliament of Sint Maarten is embroiled in intense debates over critical economic and governance issues, with Members of Parliament (MPs) demanding clarity and accountability from the Minister of Tourism, Economic Affairs, Transport, and Telecommunications (TEATT), Grisha Heyliger-Marten. The discussions have centered on the impact of U.S. tariffs, GEBE's accountability, and the broader performance of the current coalition government. Former Minister of Public Health, Social Development, and Labor (VSA), MP Omar Ottley, has been particularly vocal, calling out what he describes as the "worst government since St. Maarten obtained its country status."

Are Sint Maarten’s Goods Subject to U.S. Tariffs?

One of the most pressing questions raised in Parliament is whether goods originating from Sint Maarten are subject to the 10% baseline tariff imposed by the United States under the global tariff policy announced by the administration of U.S. President Donald Trump. This policy, which has had significant implications for global trade, could severely impact Sint Maarten’s economy if the island is formally listed as a jurisdiction subject to the tariff.

MPs have demanded that the Minister of TEATT confirm:

- Whether Sint Maarten is officially listed as a jurisdiction subject to the baseline tariff rate.

- When the Government of St Maarten was first informed of this classification, if applicable.

Additionally, Parliament has called for the Ministry of TEATT to:

- Conduct an assessment of which specific goods exported from Sint Maarten to the United States could be affected by the tariff, including re-exports and goods transiting through U.S. ports.

- Provide data on the total value and categories of goods exported to the U.S. over the past five years that could potentially fall under this tariff regime.

- Evaluate whether these tariffs could indirectly increase the cost of construction materials, retail goods, or other imports destined for Sint Maarten that pass through U.S. supply chains.

A Call for a Diplomatic Strategy

MPs have also urged the Minister to commit to presenting Parliament with a detailed strategy outlining how the Government intends to secure tariff exemptions or clarifications for St. Maarten. This strategy should include:

- Diplomatic engagement with the Kingdom of the Netherlands to leverage its influence in trade negotiations.

- Direct discussions with U.S. trade authorities to clarify Sint Maarten’s position and seek exemptions.

Such a strategy is critical to protecting the island’s economic interests and ensuring that local businesses and consumers are not disproportionately affected by global trade policies.

GEBE Accountability: A Missed Deadline

Another major issue dominating parliamentary discussions is the accountability of GEBE, the island’s utility company. On February 11, the Minister of TEATT gave GEBE 30 days to address specific issues. With the deadline now passed, MP Omar Ottley demanded answers on whether GEBE has met the requirements set by the Minister and what actions will follow if it has not.

MP Omar Ottley has been particularly critical, stating, “If GEBE goes up again, I will personally bring motions on each and every minister. If it fails, it fails, but I will do my job as a Member of Parliament and stand for the people.”

Ottley’s comments reflect growing frustration among MPs and the public over what they see as a lack of accountability and broken promises from both GEBE and the government.

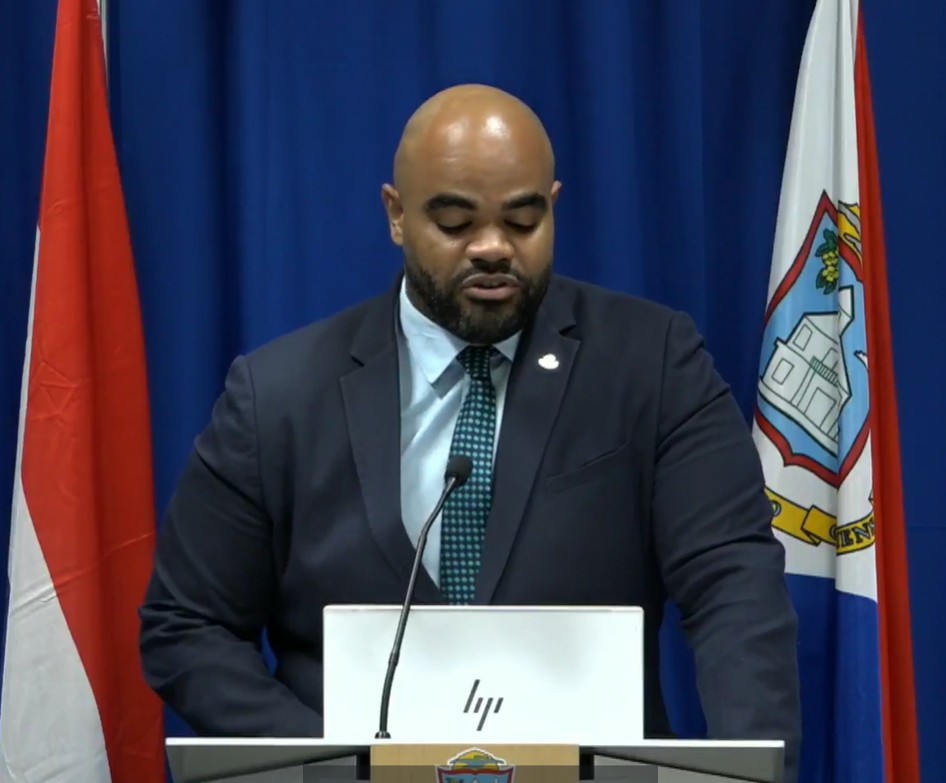

MP Omar Ottley’s Criticism of the Coalition Government

MP Omar Ottley did not hold back in his criticism of the current coalition government, calling it the "worst government since St. Maarten obtained its country status." He expressed frustration over repeated delays, rejected motions, and the lack of progress on critical issues.

“Motions upon motions, and they voted against,” Ottley said, highlighting the government’s failure to act on proposals aimed at addressing the island’s economic challenges. He also pointed out that many of the issues being debated today, such as maximum tariffs on Sol, were already included in previous motions and recommendations that were ignored.

Ottley added, “I told you so. Now we hear MPs speak of maximum tariffs on Sol, but all that was in motion.”

Parliamentary Agenda: Broader Economic Concerns

The current parliamentary session also includes discussions on several other critical issues:

- U.S.-China Trade War: The broader economic implications of the U.S.-China trade war and its potential impact on Sint Maarten’s economy are being analyzed. This includes how the island can navigate the challenges posed by shifting global trade dynamics.

- Tourism Growth via Events: Large-scale events like the Soul Beach Music Festival are seen as key drivers of tourism and business growth. Parliament is seeking data and projections on the economic impact of such events to justify continued investment in tourism.

- Vendor Marketplace Delay: The prolonged delay in building the vendor marketplace, originally scheduled to begin in August 2024, has raised concerns about its impact on small businesses. Parliament is demanding a clear timeline and actionable steps to address this delay.

The Path Forward

The debates in Parliament reflect the urgent need for a cohesive and proactive approach to addressing Sint Maarten’s economic challenges. From securing tariff exemptions to holding GEBE accountable and accelerating delayed projects, the government must act decisively to protect the island’s economic interests and restore public trust.

As MP Ottley stated, “If it fails, it fails, but I will do my job as a Member of Parliament and stand for the people.” His commitment to holding the government accountable underscores the growing demand for transparency, action, and leadership in addressing the challenges facing Sint Maarten.

The people of Sint Maarten will be watching closely to see whether their leaders can rise to the occasion and deliver on their promises. Whether through diplomatic engagement, infrastructure development, or targeted economic policies, the government must demonstrate its commitment to securing a stable and prosperous future for the island.

PHILIPSBURG:---The Ministry of Justice in St. Maarten has been making significant strides in reforming and strengthening the island's justice system. During Wednesday’s press briefing, Minister of Justice Nathalie Tackling highlighted several key developments that reflect the progress being made in public safety, cooperation, and institutional reform.

PHILIPSBURG:---The Ministry of Justice in St. Maarten has been making significant strides in reforming and strengthening the island's justice system. During Wednesday’s press briefing, Minister of Justice Nathalie Tackling highlighted several key developments that reflect the progress being made in public safety, cooperation, and institutional reform. PHILIPSBURG:--- Minister of Public Housing, Spatial Planning, Environment, and Infrastructure (VROMI), Patrice Gumbs Jr., has announced significant changes to the district cleaning contracts, aimed at improving efficiency and ensuring fairness in the tendering process. The restructuring comes as part of the government’s broader efforts to address challenges in public contracting and provide better services to the community.

PHILIPSBURG:--- Minister of Public Housing, Spatial Planning, Environment, and Infrastructure (VROMI), Patrice Gumbs Jr., has announced significant changes to the district cleaning contracts, aimed at improving efficiency and ensuring fairness in the tendering process. The restructuring comes as part of the government’s broader efforts to address challenges in public contracting and provide better services to the community. PHILIPSBURG:--- Minister of Public Housing, Spatial Planning, Environment, and Infrastructure (VROMI), Patrice Gumbs Jr., announced the retendering of solid waste contracts after all bids submitted in the initial process were disqualified for procedural discrepancies. However, this decision has drawn sharp criticism as the island grapples with a growing waste management crisis and broader governance challenges.

PHILIPSBURG:--- Minister of Public Housing, Spatial Planning, Environment, and Infrastructure (VROMI), Patrice Gumbs Jr., announced the retendering of solid waste contracts after all bids submitted in the initial process were disqualified for procedural discrepancies. However, this decision has drawn sharp criticism as the island grapples with a growing waste management crisis and broader governance challenges. PHILIPSBURG — The Police Force of Sint Maarten (KPSM) is continuing its investigation into a break-in at the Receiver’s Office and Postal Services St. Maarten (PSS) on Soualiga Road, with new details raising questions about the circumstances of the incident.

PHILIPSBURG — The Police Force of Sint Maarten (KPSM) is continuing its investigation into a break-in at the Receiver’s Office and Postal Services St. Maarten (PSS) on Soualiga Road, with new details raising questions about the circumstances of the incident.